Is it time you outsource payroll services?

Let me ask you one question. Does your company specialize in providing payroll services? If your answer is no, then why use valuable in-house time and resources to do this complex, time consuming (and somewhat risky) task?

It probably made good sense when you first started your business. You figured that it saved you money, and by managing the process yourself, you could review payroll data quickly and easily. Plus the software seemed so basic—anyone could figure it out, right?

But with added staff and a more complex business, “doing payroll” has become increasingly time consuming. The software isn’t nearly as easy as you thought (and it needs updating again), plus there’s been a couple of errors this past year that could have landed you in hot water. You’ve since hired someone in-house to do payroll, but that’s an added expense, and you’re not sure he or she is up-to-date with the latest rules.

Outsourced payroll provides total peace of mind

By seeking the guidance of an outsourced payroll service, business owners save valuable time and resources. Check out these facts:

- A full time in-house payroll manager costs money. Companies can save an average of $58,000 to $95,000 CAD annually by switching to a trusted outsourced payroll provider that focuses on exactly what your business requires.

- Typically, a payroll manager takes care of retirement plan management, tax preparation, automatic pay cheque deductions, and employee benefits administration. These payroll-related responsibilities demand attention that eats up time and resources—an estimated 750-1500 hours a year! Just think of what you could accomplish if you devoted the same resources toward new business development or serving your customers more effectively?

- Next for the scary part: nearly one third of employers have suffered penalties related to payroll errors. Mistakes can have a devastating financial or legal consequence. Just when you think everything is running smoothly, you end up with a hefty fine from the Canada Revenue Agency to fix something that was totally unnecessary, given the right advice,

- By outsourcing your payroll, you no longer have to dedicate time and expenses to developing and maintaining a strong working knowledge of payroll compliance standards. Experts in payroll know the latest rules and regulations. Part of their responsibility is to handle potential complications related to payroll and assume the responsibility for preventing any violations of government regulations.

Managing payroll as your company grows

Hiring an outsourced payroll service doesn’t mean that you lose control of this critical aspect of business operations. Regardless of how efficient or capable your payroll service provider, someone at your company has to be designated to serve as a liaison with the service. Certain payroll responsibilities such as sending in timesheet data, continues to be the responsibility of your company. Such responsibilities help you stay connected to the HR component of your company.

Every business goes through stages of growth and change. A significant milestone is the point at which the owner begins to let go of some of the control and gives it over to someone he or she trusts. It could be a senior manager, hired specifically suited to your industry, or a trusted advisor to provide non-core, but essential services. Taking the step to outsource payroll to a trusted provider is a part of growth, and an indication that you’re ready for success.

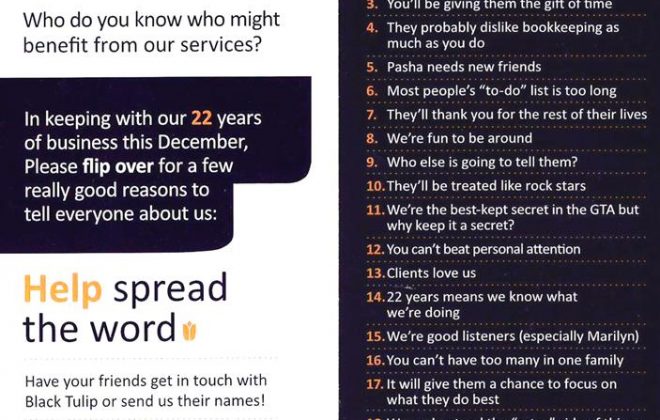

The trusted payroll specialists with Black Tulip are up-to-date with all the important payroll compliance regulations in Canada and the US, and remain committed to maintaining efficiency and accuracy for your organization. Please contact us today to learn more about our payroll expertise to help your company prosper!